Claims Made vs Occurrence Insurance Policies

Within the insurance industry, there are two types of policies. There are Claims Made policies and Occurrence policies. It is important to know which type of policy you have in order to understand how your policy will respond to a claim.

With Claims Made policies, an insured’s current policy will respond to a covered claim that is reported within the time period ranging from the retroactive date on the policy to current day. This is where the term “claims made” comes from. The policy that is active on the date that the claim is made, i.e., filed with the insurance company, will be responsible for covering the incident, subject to the terms and conditions of the policy, despite the incident giving rise to the claim potentially occurring prior to the current policy period. This differs from Occurrence policies where coverage only responds to a covered claim with an incident that happens or ‘occurs’ during its policy period. The date a claim is filed does not determine whether coverage is available; rather, the date of the occurrence determines what policy terms apply. The policy that is or was active at the time of the occurrence would be the coverage that extends to the claim, subject to its terms and conditions.

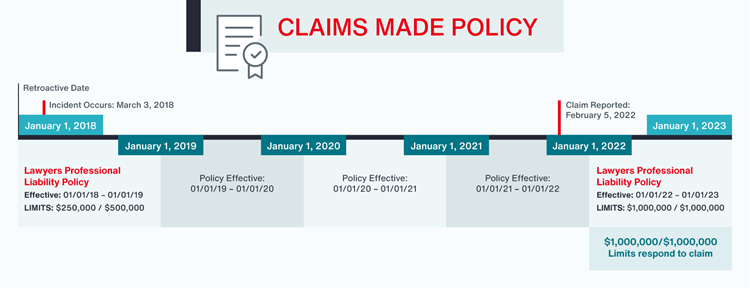

An Example of a Claims Made Policy in Action

An attorney opens a firm on January 1, 2018 and procures a professional liability policy for error and omissions coverage. This attorney starts with $250,000 per claim and $500,000 aggregate limits effective January 1, 2018 to January 1, 2019. As time progresses, the limits are increased by the firm due to the attorney taking on larger clients. By 2022, the firm has $1 million per claim and $1 million aggregate limits in place effective January 1, 2022 to January 1, 2023.

A bar complaint is filed during the 2022-2023 policy term for an incident that occurred in 2018. Which policy would respond in the event of a covered claim? The 2022-2023 policy would respond with the $1M limits. This is determined by when the claim was filed and not when the incident occurred because the firm has a claims made policy, as is common in the Lawyers Professional Liability Insurance industry.

Click image to view larger

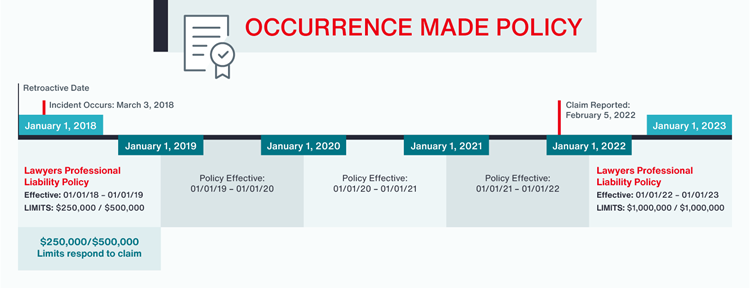

An Example of an Occurrence Policy in Action

An auto incident occurs in 2018 while an injury from the accident is not reported and determined to be covered until 2022. The auto liability policy issued for the January 1, 2022 to January 1, 2023 policy period will not respond to a 2018 claim; rather, the auto policy that was effective at the time of the 2018 incident will respond. For occurrence policies, the policy terms that were or are in effect during the time of the incident will apply to the claim. Therefore, the 2018 policy terms apply in this scenario. This type of insurance policy is common amongst personal lines of insurance (auto, health, property) and even specialized types of insurance, such as coverage for special events, sports, or motorsports.

Click image to view larger

Making Sure Coverage is in Place for Potential Claims

Another important aspect to consider when looking at policy types is how long does coverage extend to covered claims. For Claims Made policies, coverage is only effective for as long as the insured has an active policy in place and only for covered claims that occur after the retroactive date on the policy.

An exception to this would be in the case of an Extended Reporting Period being purchased. An Extended Reporting Period (ERP), also known as Tail coverage, allows a policy to extend for an allotted amount of time beyond the policy’s original expiration date thus providing additional time for coverage to extend to reported claims.

Another exception would be Prior Acts coverage that will allow coverage to extend to covered claims that occur prior to the effective date on the policy. Without Prior Acts coverage, an insurer will not extend coverage to claims that result from an incident that occurs prior to the effective date on the policy.

Both exceptions, Extended Reporting Periods and Prior Acts coverage, are applicable solely to Claims Made policies. Occurrence policies do not need these options. Coverage will extend to a covered loss no matter the amount of time it takes for a claim to be reported. With Occurrence policies, coverage applies indefinitely for incidents that occur during a policy period even if a claim is reported after the policy expires. Keep in mind though that the terms and limits that apply will be those of the policy that is or was active at the time of the occurrence regardless of what policy is active when the claim is reported. Due to the vast lifespan of coverage on Occurrence policies, these types of policies tend to cost more than Claims Made policies.

Summation

This is a high-level view of insurance policies. Coverage is always subject to the particulars of each individual issued policy. For example, there may be an endorsement on a Claims Made policy that prevents an increase in policy limits to retroactively date back to a prior policy period. This is why it is paramount to read your policies and ask questions!

This information is provided for general informational purposes only and is not intended to provide individualized business, insurance, or legal advice. All descriptions, summaries or highlights of coverage are for general informational purposes only and do not amend, alter or modify the actual terms or conditions of any insurance policy. Coverage is governed only by the terms and conditions of the relevant policy.